-

- Creation of Individual Wallets for Inquirer and

Real Estate-Related Companies - Upon membership registration, wallets are generated after authentication.

- Creation of Individual Wallets for Inquirer and

-

- Direct Token Transactions without Central System Intervention

- Smart contract transactions take place directly on the Klaytn platform.

-

- Token Rewards for Inquirer Activities

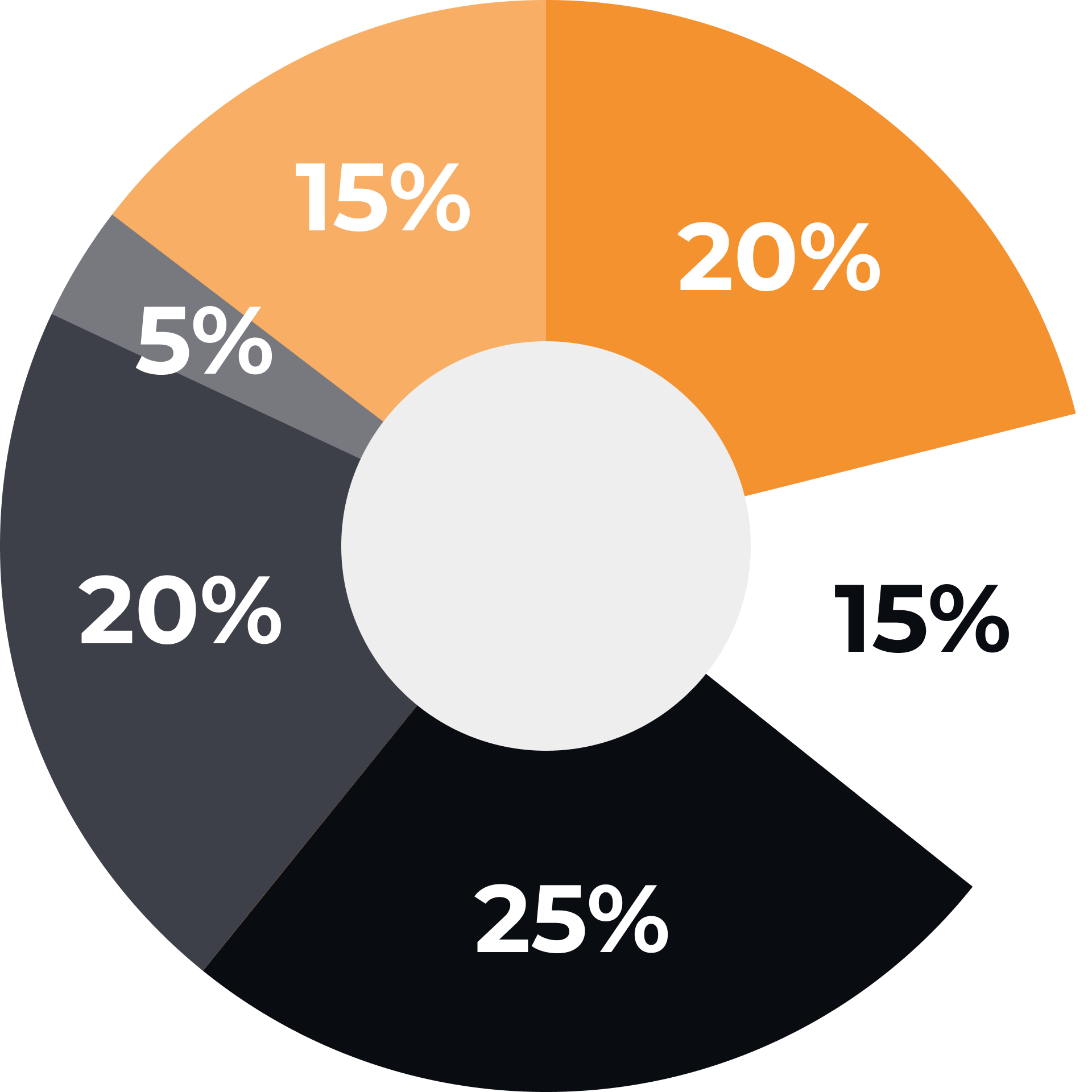

- Automatically rewarded based on the activity reward rate of the Financial & real estate monitoring system.

Verify whether real estate-related company wallets have the reward criteria(e.g., 5,000 KROS) before transactions and inform the respective companies. - If not held, payment is made from the Financial & real estate wallet, and a charge is sent to the real estate-related company.

Financial & real estate PROTOCOL

Blockchain System Overview